From a regulatory perspective, The state of cryptocurrency today is analogous to the state of mutual fund investments in the United States in the 1940s. From 2008-2017, it was considered the “Wild West” of crypto. But starting in 2019, I anticipate both a greater understanding by regulators of the unique characteristics and challenges of crypto as well as greater regulation.

Any discussion of increased regulation seems to bring out a vocal group against regulation. In part, this group is distrustful of government intentions and motivations. However, my expectation is that increased regulation is a certainty as well as a great boon for the crypto industry as a whole.

Back in the 1940s, the mutual fund industry had recently suffered a huge loss in confidence due to manipulative practices of advisors and some insider investors serving as a detriment of the majority of ordinary individuals. Information asymmetry meant that a select few investors were able to use insider information to effectively trade ahead of the majority of other investors. Pump-and-dump schemes were common and resulted in ordinary investors being scammed into buying shares of mutual funds at inflated prices before they crashed. Conflicts of interest meant that fund advisors could charge fees that were hidden and undisclosed, or engage in transactions that benefited them to the detriment of investors.

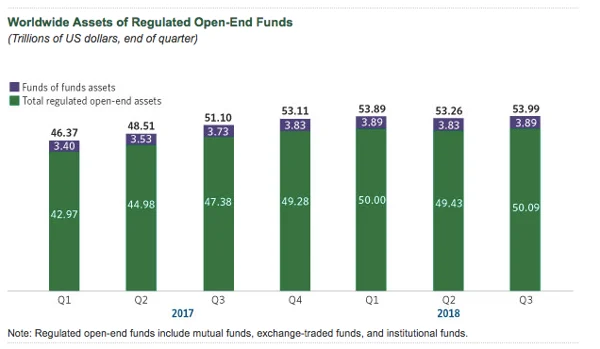

When Congress finally passed laws governing the conduct of advisors and fund companies by passing the Investment Advisers Act of 1940 and the Investment Company Act of 1940 (the “40 Acts”), the abuses suffered by individual investors abated. Investment advisors were then subject to fiduciary standards meaning that they always had to act in the best interests of their investors. Fund companies were subject to laws prohibiting excessive and undisclosed fees and “conflicts of interest” transactions. The 40 Acts gave the SEC the power to investigate and punish perpetrators of manipulative practices through fines, sanctions and other civil penalties which effectively put bad actors out of business. After the passage of the 40 Acts, the mutual fund industry grew from less than $1 billion in assets under management to over $50 trillion globally today. This happened because mainstream investors gained confidence in the industry and trusted that the involvement of regulators would mean a level playing field, relatively speaking.

Source: ICI Global

Source: ICI Global

Recently, Valerie Szczepanik, the SEC’s “Crypto Czar,” was quoted as saying that “crypto spring” is coming. Hand-in-hand with that comment were Ms. Szczepanik’s comments that entrepreneurs and innovators should engage in dialogue with the SEC. Former CFTC Chairman Timothy Massad in a Brookings Institute report also called for strengthening regulation of cryptocurrency.

The most obvious area where I see regulations coming into play is the regulation of exchanges on a national level, whether securities exchanges (by the SEC) or non-securities exchanges (possibly by the CFTC). By far, exchanges are the most critical connection in the trading of crypto and the biggest influence on prices. They are also the most opaque, with allegations of volume-faking (through wash trading, for example), lack of security controls (QuadrigaCX, for example), undisclosed conflicts-of-interest and front-running, and unknown leadership, amongst others.

My opinion is that the only way “crypto spring” will come is through greater regulation. When it does come, it will be great for the industry. I expect that the crypto industry will be strengthened and more money; people and institutions will participate, and values of legitimate crypto projects will increase. Those who anticipate this and work within the emerging regulatory system will be prepared to seize the opportunity to profit from mainstream acceptance.